The Tax Benefits of a College Savings Plan (529 Plan)

- Samantha Hawkins

- Dec 4, 2024

- 1 min read

Updated: Dec 9, 2024

A 529 plan is typically set up in the form of a savings or investment account, where the money contributed grows tax-free as long as the withdrawals are for qualified education expenses.

There are two types of 529 plans:

• College Savings Plan - investments grow tax-free and can be withdrawn tax-free for educational expenses such as tuition, room and board, and required textbooks.

• College Prepaid Plan - prepay part or all of an in-state public tuition, locking in the tuition at time of payment

529 plans are operated at the State-level, not the Federal-level, and the requirements vary by State. As an added benefit, some states offer a tax deduction or tax credit for contributions made to the State’s 529 plan.

Click here for more information on 529 Plans by State.

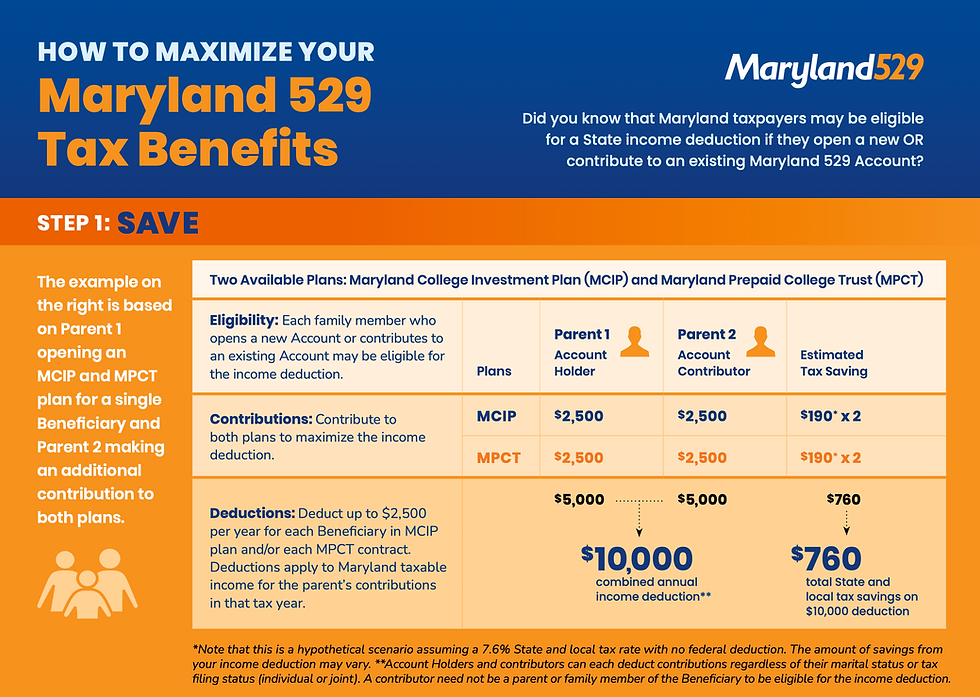

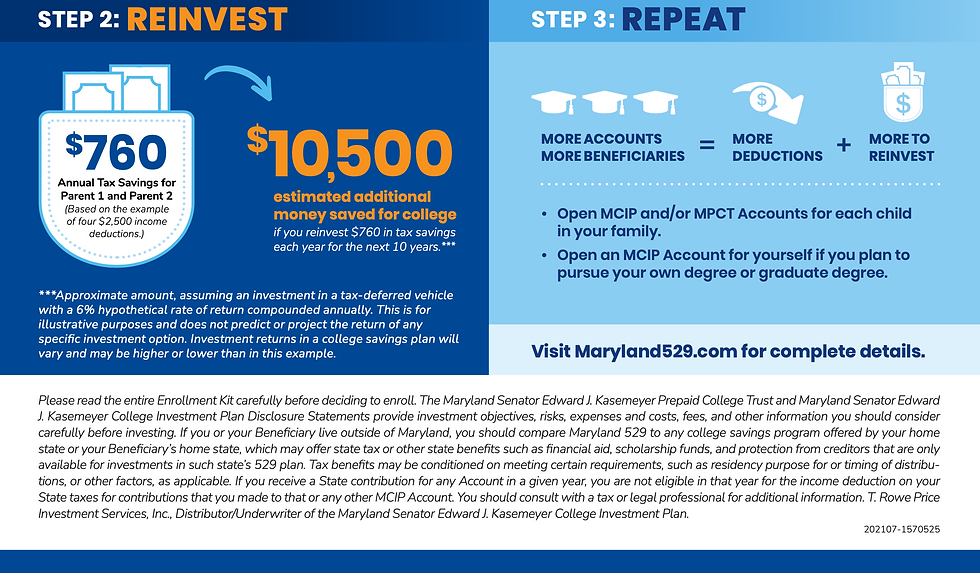

Below is a hypothetical of how a taxpayer could potentially maximize the tax benefits of a Maryland 529 Plan.

Comments